capital gains tax rate uk

The applicable rate will be determined by reference to the non-UK. Ad From Enquiry to Live within 24 hours get your Property Online with a Quick Turn Around.

Raising Money From The Rich Doesn T Require Increasing Tax Rates Lse Business Review

You may need to pay capital gains tax CGT on shares you own if you sell them for a profit.

. Other organisations like limited companies pay Corporation Tax on profits from selling their. From this date Capital Gains are calculated at either an 18 or 28 tax rate dependent upon the amount of your other taxable income during the tax year. In the UK Capital Gains Tax for residential property is charged at the rate of 28 where the total taxable gains and income are above the income tax.

4 rows For the 20222023 tax year capital gains tax rates are. Capital gains tax rates on shares. Gains from selling other assets are charged at.

Gains which when added to taxable income fall in the UK higher or UK additional rate tax band. If your taxable income is Higher Rate or Additional Rate. Your entire capital gain will be taxed at a rate of 20 or 28 in the case of the residential property provided your yearly income exceeds 50270.

Report and pay HMRC within 60 days of. The amount of tax youre charged depends on which income. Capital gains arising from the sale of inherited assets will have.

The rate that you pay depends on your total taxable income so youll need to work this out before you refer to the rates below. Capital Gains tax APR. For individuals the CGT charge will be at 18 for basic rate taxpayers and at 28 for higher and additional rate taxpayers.

With Years Of Experience We Can Help You At Any Stage Of Your Holiday Letting Journey. If you have made a profit from both property and other. If your taxable income was in the Basic income tax band you would pay 18 on any capital gains made on the sale of resident property.

If you have assets disposed before. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable. Personal tax advice whether youre a sole trader UK expat investor landlord and more.

Capital gains tax rates on property UK are 18 for basic rate taxpayers and 28 for high rate taxpayers. Work out the Capital Gains Tax rate. Find out when you need to pay Capital Gains Tax as a non-resident selling UK property or land.

With Years Of Experience We Can Help You At Any Stage Of Your Holiday Letting Journey. Individuals are allowed to deduct up. 10 18 for residential property.

28 of 87700 a 24556 tax bill. Ad From Enquiry to Live within 24 hours get your Property Online with a Quick Turn Around. However the capital gains tax rate on shares are 10 for basic rate.

Ad Well pair you with a certified accountant who can chat through your questions and options. Its not taxable if an inheritance passes down a primary residence. You pay Capital Gains Tax if youre a self-employed sole trader or in a business partnership.

Thus a primary residence sale doesnt result in taxable gains. UK Capital Gains Tax rates. Capital gains tax rates for 2022-23 and 2021-22 If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher.

Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. Currently the capital gains tax for such individuals is 11300 2021. As you are a higher rate taxpayer and this is a propery you pay CGT as a rate of 28.

Capital gains on residential property which is not a main residence will be taxed at. Ad Well pair you with a certified accountant who can chat through your questions and options. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax.

Personal tax advice whether youre a sole trader UK expat investor landlord and more. To encourage longer- term investments the federal tax law sets three brackets that usually result in a lower tax rate on long-term capital gains. Capital gains tax applies when your land sale is more than your yearly exemption.

6 Best Crypto Tax Software S 2022 Calculate Taxes On Crypto

Beware Capital Gains Tax Looks Set To Be Overhauled

A Clever British Campaign Against Higher Capital Gains Tax Rates Cato At Liberty Blog

Tax Efficient Etf Investing Justetf

Capital Gains Tax When Selling A Business Asset 1st Formations

Capital Gains Tax Low Incomes Tax Reform Group

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

Managing Tax Rate Uncertainty Russell Investments

Capital Gains Tax Overhaul Draws Closer Financial Planning Corporation

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Double Taxation Of Corporate Income In The United States And The Oecd

Ultimate Guide To Capital Gains Tax Rates In The Uk

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Savings And Investment Oecd Capital Gains Tax Retirement Accounts

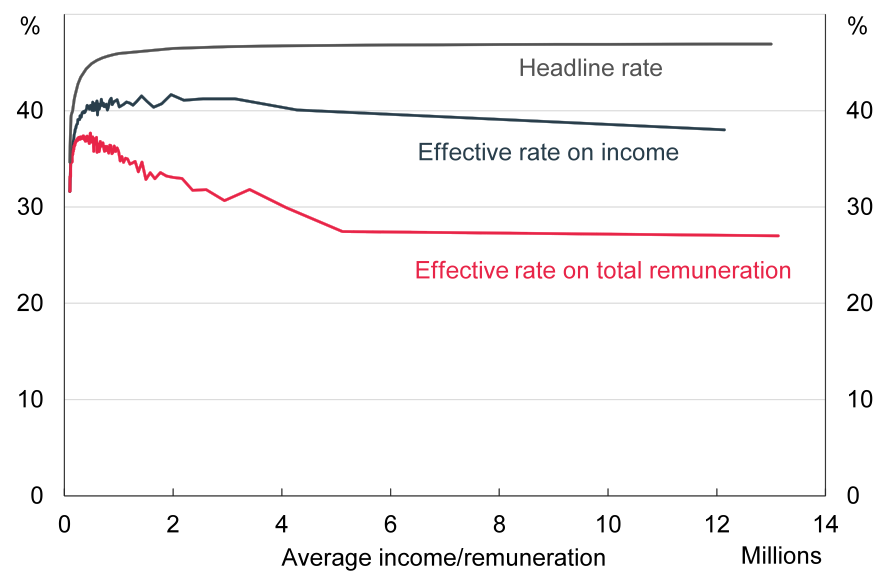

Ifs Uk S Richest People Exploiting Loophole To Cut Tax Rate Tax Avoidance The Guardian

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Uk Gov T Unveils Cryptocurrency Tax Guidelines For Individuals Bitcoinist Com

Tax Considerations For Foreigners Investing In Uk Real Estate Htj Tax